Auto Buyers

Are you planning to buy an auto, motorcycle, ATV, boat or camper in the future?

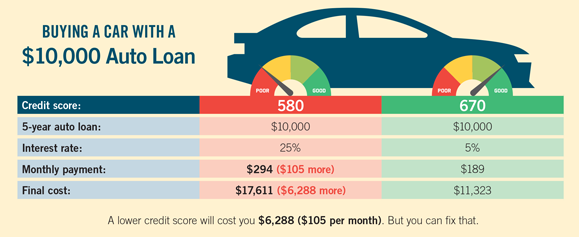

Remember that your credit scores will determine the amount of interest that you’ll pay. Consumers with low credit scores will often pay more (in interest payments) for the same product than consumers with high credit scores.

Look at this example: